A home that’s right for you

Choosing a home loan is personal. Our step-by-step guides are a great way to identify your goals and explore your options.

Whether you’re buying your first home, refinancing or looking for an investment property, let’s figure out the essentials together.

I am looking to…

No matter where you are on your home buying journey, our guides will walk you through.

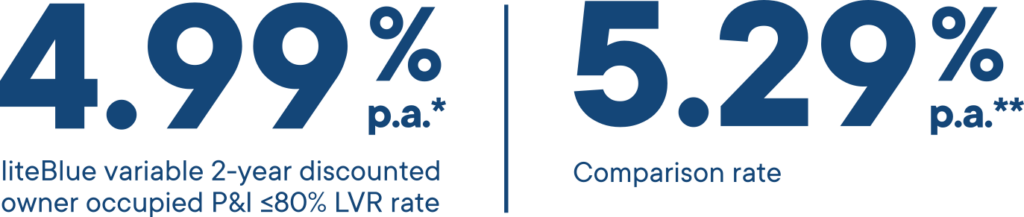

liteBlue Variable Rate home loan

5.24% p.a.^

liteBlue variable rate owner occupied <60% LVR

5.25% p.a.^^

comparison rate

- Variable rate

- Fixed rate (1-5 years)

- $199 application fee

- No ongoing fees

- Free unlimited online redraw

- Additional repayments

- Top up available

- Split loan available

- Construction loan available

- 30 year maximum loan term

myBlue Fixed Rate home loan

5.19% p.a.^

myBlue 1 year fixed rate owner occupied <60% LVR

5.33% p.a.^^

comparison rate

- Variable rate

- Fixed rate (1-5 years)

- No application fee

- No ongoing fees

- Free unlimited online redraw

- Additional repayments

- Top up available

- Split loan available

- Construction loan available

- 30 year maximum loan term

- Up to eight 100% interest offset accounts

myBlue Variable Rate home loan

5.34% p.a.^

myBlue variable rate owner occupied <60% LVR

5.34% p.a.^^

comparison rate

- Variable rate

- Fixed rate (1-5 years)

- No application fee

- No ongoing fees

- Free unlimited online redraw

- Additional repayments

- Top up available

- Split loan available

- Construction loan available

- 30 year maximum loan term

- Up to eight 100% interest offset accounts

Looking after your home loan

It’s easy to manage your Hume Bank home loan – whether you want to keep things ticking over, start getting ahead on your payments, or taking a bit of pressure off.

Get the ball rolling

Every great relationship needs someone to make the first move. There are three ways you can get the ball rolling with us and make an application – we can’t wait to hear from you.

Crunch the numbers

The best decisions are informed decisions. Understand your borrowing power and repayment options by using our handy online tools and calculators.